Introduction to Crypto Trading

Crypto trading has gained popularity due to massive potential profits and the decentralized nature of digital assets—which offer greater privacy and investment control.

If you’re new to crypto trading, this post will provide an overview of what you need to know to get started confidently. Discover the benefits and risks in trading, the types of trading, and insider tips for success.

What is Crypto Trading?

Crypto trading refers to the buying and selling digital assets on a crypto exchange platform. You can trade cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Binance coin (BNB), Litecoin (LTC), and many others.

Crypto trading can be done on a Centralized Exchange (CEX) like Binance or Kucoin or a Decentralized Exchange (DEX) like Pancakeswap or Uniswap.

Types of Crypto Trading

There are three types of crypto trading. Depending on your level of trading experience, they include spot trading, margin trading, and futures trading.

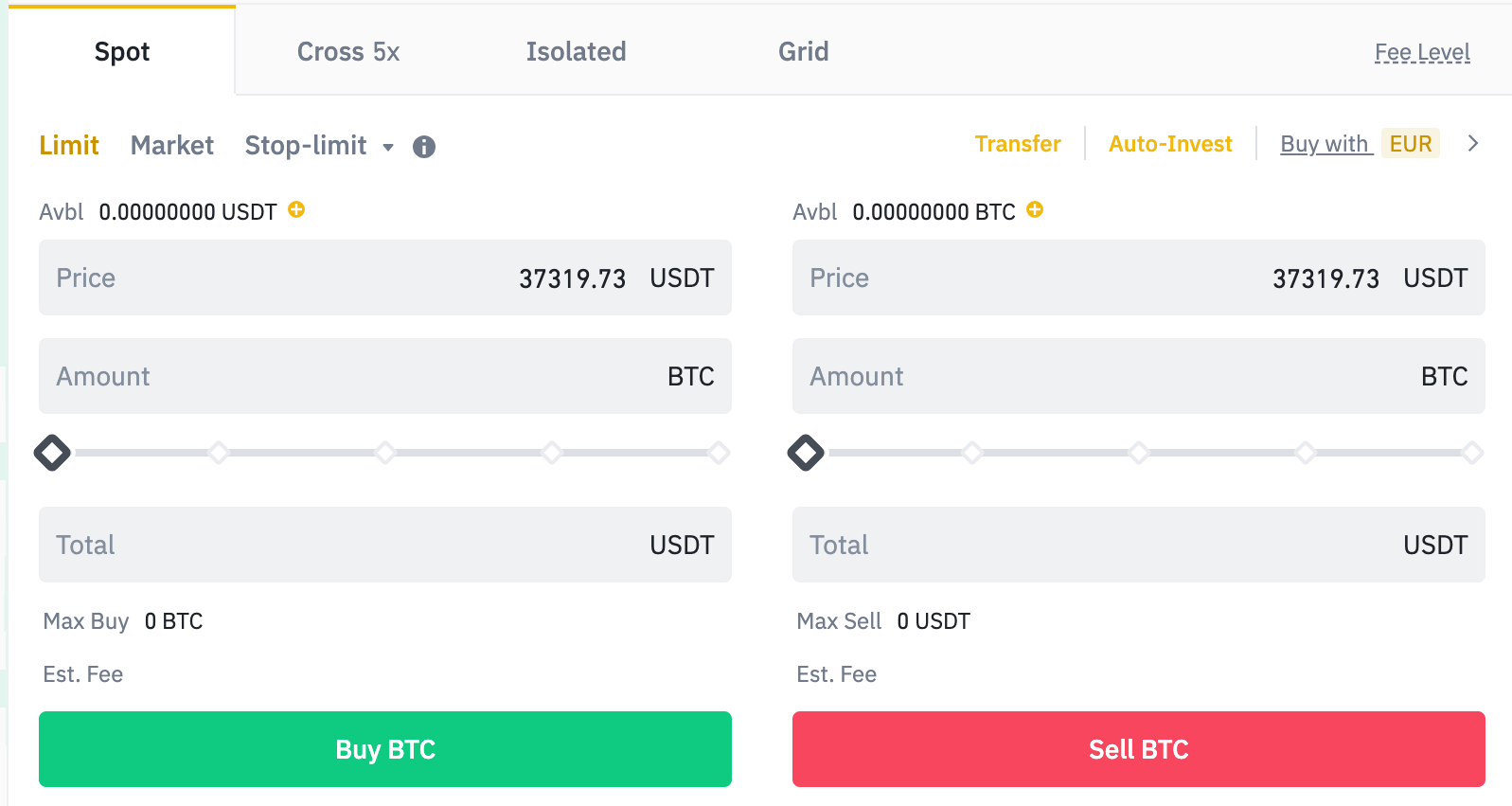

Spot Trading

Spot trading refers to the immediate buying and selling of cryptocurrencies at the current market price. This is the most common type of trading and is relatively straightforward.

Spot trading is recommended for traders just starting out as it requires little technical know-how.

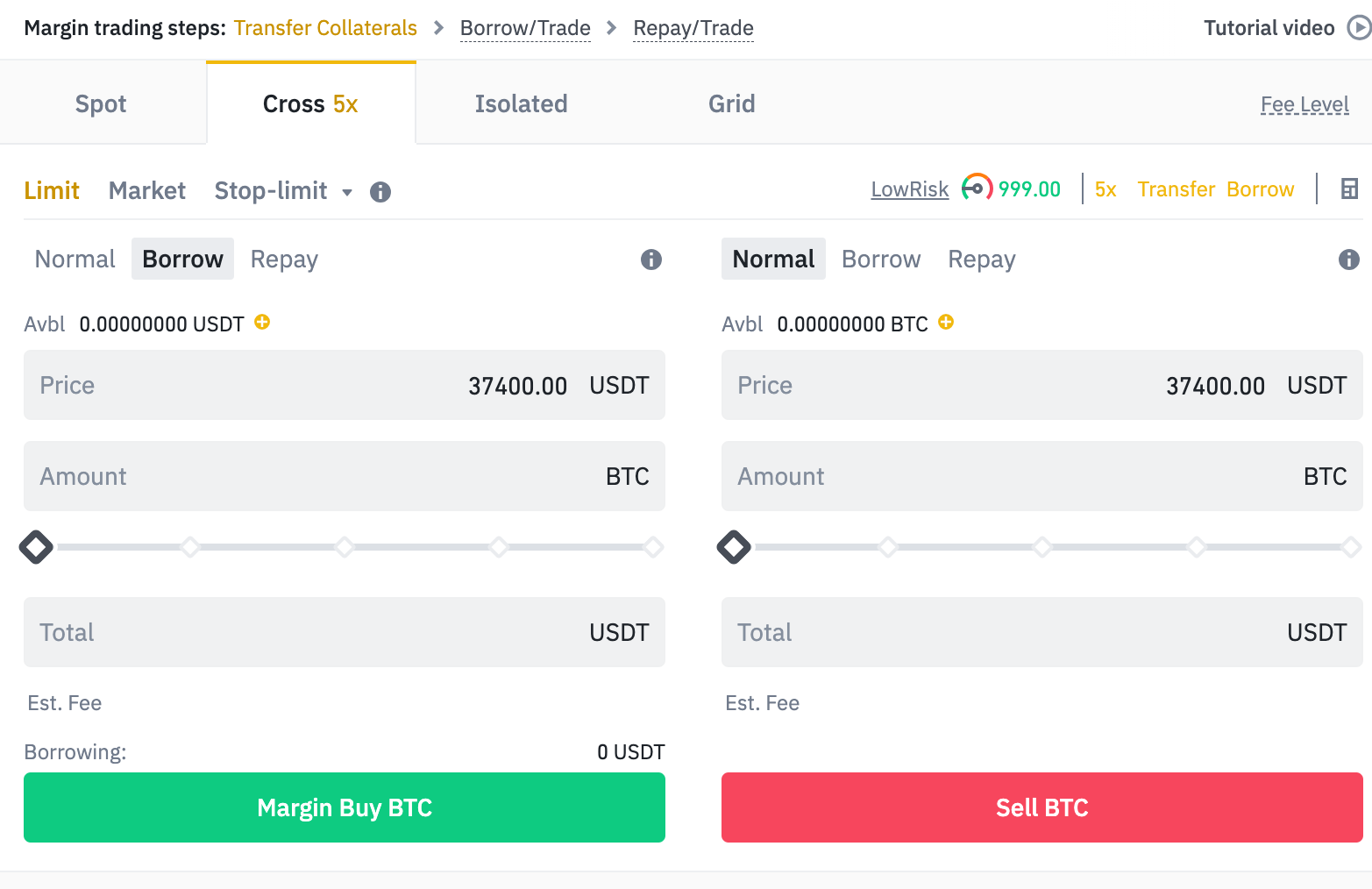

Margin Trading

Margin trading allows traders to borrow funds from an exchange to increase their buying power and potentially increase their profits.

With Margin trading, you’re increasing your leverage by using a smaller capital to trade in a much larger volume.

Futures Trading

Futures trading is an advanced form of trading for expert traders. It involves buying or selling cryptocurrencies at a predetermined price at a future date.

Futures trading allows traders to hedge against market volatility and potentially lock in profits, but it also requires a higher level of expertise and risk management.

Benefits of Crypto Trading

Crypto trading has several significant advantages that continue to attract people to it. They include:

- Decentralization — Cryptocurrency trading operates independently of banks and other financial institutions. You’ll enjoy faster, more secure, and cost-effective transactions.

- Transparency in Transactions — Crypto trading transactions are recorded on a public ledger visible to all network participants — providing high transparency and accountability, reducing the risk of fraud, and enhancing trust between the parties involved.

- High Liquidity — With high cash flow into cryptocurrencies, it is easy to buy and sell cryptocurrencies anytime. This allows traders to enter and exit positions quickly.

- Potential for High Return on Investment (ROI) — With a history of growth and optimistic future predictions, cryptocurrency trading is a source of high investment returns.

Risks of Crypto Trading

Crypto trading offers many potential benefits; however, it is vital to be aware of the major risks, which include:

- High Volatility — The crypto market is known for significant price fluctuations in a short period, resulting in substantial gains or losses for traders.

- Lack of Regulation — The absence of regulation in the crypto market can make it more susceptible to fraud, scams, and hacks.

- Cybersecurity Risks — Crypto trading is vulnerable to cybersecurity risks such as hacking, phishing, and malware. Traders must use strong passwords and two-factor authentication and secure their private keys to protect their investments from theft or loss.

Getting Started With Crypto Trading

Ready to get started? Here are some key steps to take.

Choose a Reputable Cryptocurrency Exchange

There are many cryptocurrency exchanges, but selecting a reputable one with a solid security and reliability track record is essential. Look for exchanges with strong user reviews and various trading pairs.

Create and Fund an Account

Once you have selected a crypto exchange, create an account and fund it with cryptocurrency or fiat currency. Most crypto exchanges require users to verify their identity before they can begin trading.

Quick Tip for Successful Crypto Trading

Successful crypto trading requires discipline, patience, and a willingness to learn from successes and failures.

Traders use fundamental and technical analysis to avoid blind trading. Fundamental analysis looks at the underlying factors and the asset’s intrinsic value, while technical analysis involves analyzing market data and price charts for trends.

Staying up-to-date with market news and diversifying portfolios are also essential for minimizing risk.

To succeed in crypto trading, you should establish achievable goals and a trading strategy and adhere to them consistently. Enlist a well-defined risk management plan, such as diversification, implementing stop-loss orders, and limiting exposure to high-risk assets.

Final Thoughts

While crypto trading may initially seem intimidating, anyone can become a successful trader with the right approach and resources.

Regardless of your experience in investing, implementing the best security and privacy practices and conducting thorough research before investing can give you an edge in the crypto market.

Go ahead and confidently explore the world of crypto trading and discover the many exciting opportunities it offers.

0 Comments Add a Comment?